45 calculating tax math worksheets

Calculating Tax Worksheet Teaching Resources | Teachers Pay Teachers This resource is great for students who need practice calculating tax, gratuity and discounts from word problems. Problems include scenarios where students are given a total amount of a bill, tax and gratuity percent, and students need to calculate the final amount. Students should know which to calculate first, second, and so on… Markup, discount, and tax - Math Worksheet x 155 = 12 100 Now, cross multiply. x ∙ 100 = 12 ∙ 155 100 x = 1860 x = 18.6 18.6 is 12% of 155. Example 2: Let's try another. 9 is what percent of 215? 9 will be our "IS", 215 is our "OF" and we are looking for our percent. 9 215 = x 100 9 ∙ 100 = x ∙ 215 900 = 215 x x = 4.19 Now let's apply this to shopping and figuring out discounts and taxes.

Applying Taxes and Discounts - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount. Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied. ...

Calculating tax math worksheets

Calculating Total Cost after Sales Tax - Liveworksheets.com You can do the exercises online or download the worksheet as pdf. ... Finding Sales Tax and Total Cost after it is applied. ... School subject: Math Everyday Math Skills Workbooks series - Money Math - CDÉACF invisible. But math is present in our world all the time – in the workplace, in our homes, and in our personal lives. You are using math every time you go to the bank, buy something on sale, calculate your wages, calculate GST or a tip. Money Math is one workbook of the Everyday Math Skills series. The other workbooks are: • Kitchen Math Calculating Tax- purchase worksheet ID: 1239539 Language: English School subject: Math Grade/level: Special Education Age: 11+ Main content: Making purchases, calculating tax Other contents: addition Add to my workbooks (11) Download file pdf Embed in my website or blog Add to Google Classroom

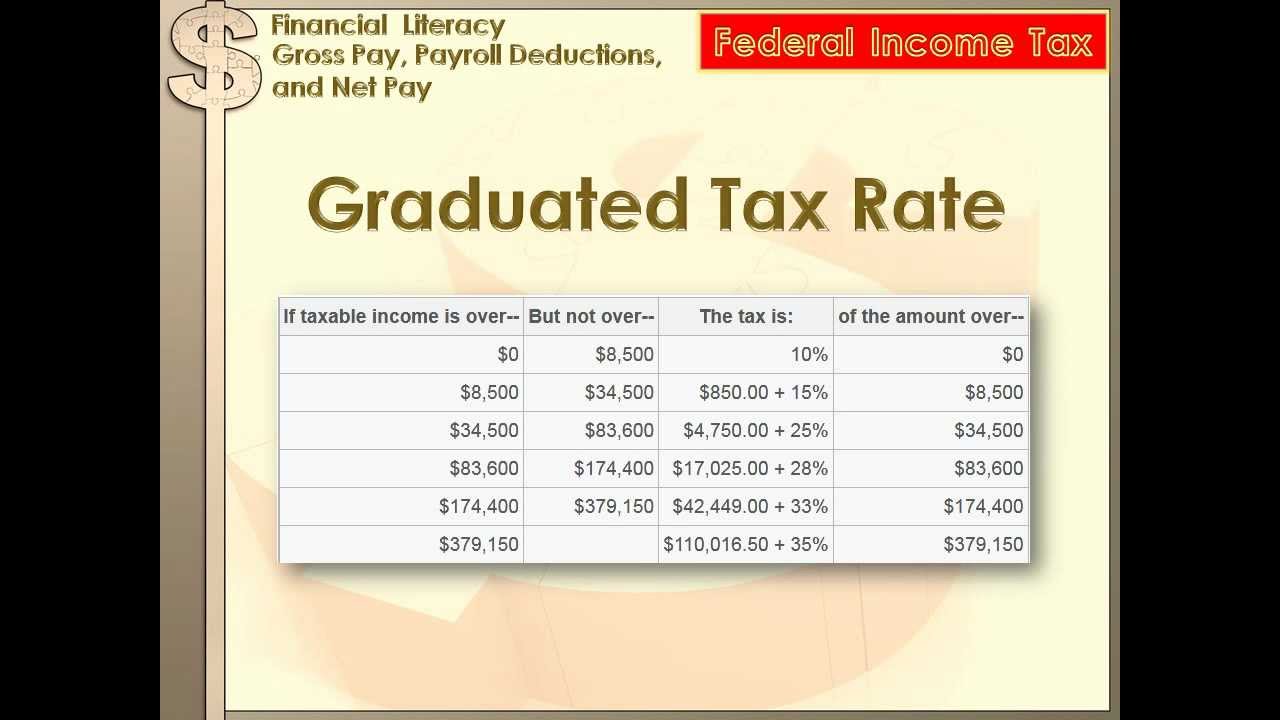

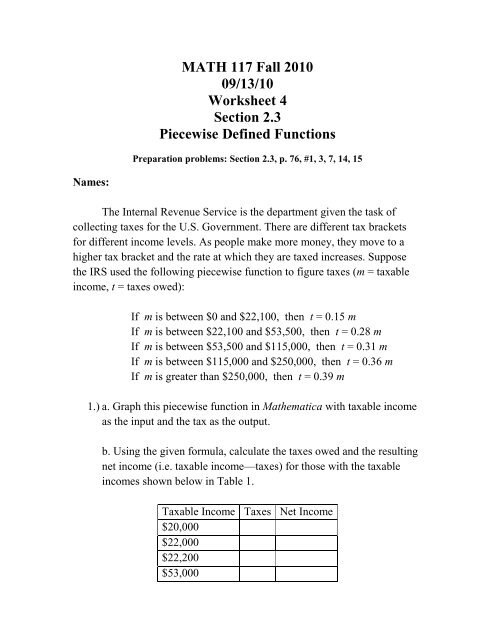

Calculating tax math worksheets. Consumer Math - Basic-mathematics.com Real state tax Learn how a property tax is calculated using some basic math skills. Topics in investment Bonds Learn about what bond, face value, and how to calculate the cost of bond given the face value and the percent shown on the face value. Calculating Sales Tax Ontario Teaching Resources | TpT This resource will allow you to teach your students about sales tax in Ontario, how to calculate it, and then will allow them to practice this new knowledge through a fun worksheet activity!This resource also meets various expectations w. Subjects: Decimals, Math, Numbers. Grades: 7th - 10th. Types: Income Tax worksheet - Liveworksheets.com Income Tax Calculating income tax and money received after deductions. ID: 1342388 Language: English School subject: Math Grade/level: Secondary ... More Math interactive worksheets. Matching Number Name to Numbers (1-10) by khosang: Addition DJ by CPSGradeOne: Place Value by Gierszewski: Mixed Times Table Money - Practice with Math Games Our games can be played on computers and mobile devices, and we offer other free resources (such as printable worksheets) to facilitate math review inside and outside the classroom. Pupils can use our tools to practice: Counting and understanding money values; Adding and subtracting money; Making change and interpreting price lists

Quiz & Worksheet - How to Calculate Property Taxes | Study.com Print Worksheet 1. A house has an assessed value of $250,000. The local government has a tax rate of $75 per $1,000 for calculating the property tax. What is the property tax? $20,000 $18,750... How to calculate taxes and discounts | Basic Concept ... - Cuemath The formula used to calculate tax on the selling price is given below: Tax amount = $(S.P.× T ax rate 100) $ ( S. P. × T a x r a t e 100) Let's consider an example. Let's say an item costs $50, and a sales tax of 5% was charged. What would be the bill amount? Let's first find 5% of 50. 5/100×50 = 2.5 Finding the total cost including tax or markup: Worksheets Welcome to the Percentage Increase and Decrease Worksheets section at Tutorialspoint.com.On this page, you will find worksheets on finding the final amount given the original amount and a percentage increase or decrease, finding the sale price given the original price and percent discount, finding the sale price without a calculator given the original price and percent discount, finding the ... How to Find Discount, Tax, and Tip? (+FREE Worksheet!) - Effortless Math Step by step guide to solve Discount, Tax, and Tip problems. Discount = = Multiply the regular price by the rate of discount. Selling price = = original price - - discount. Tax: To find tax, multiply the tax rate to the taxable amount (income, property value, etc.) Tip: To find tip, multiply the rate to the selling price.

Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes. ... Students use a variety of prices and tax rates to find total values. Money Math: Solve Sales Tax Word Problems | Worksheet Sales tax varies by state, so it's one of the more difficult real world math equations to determine. This worksheet gets your child moving in the right ... Worksheet - Income tax calculations - StudyMaths.co.uk Worksheet - Income tax calculations Work out how much income tax must be paid on each of these peoples earnings. Total = ? / 10 Sign in or register to record your scores and collect StudyPoints! Calculating Tax And Tip Worksheets - K12 Workbook Calculating Tax And Tip. Displaying all worksheets related to - Calculating Tax And Tip. Worksheets are Math tip work, Sales tax and discount work, Name period date tax tip and discount word problems, Tip and tax homework work, Name date practice tax tip and commission, Calculating sales tax, Markup discount and tax, Markup discount and tax ...

Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX Discount and Sales Tax Lesson Plan Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

Browse Printable 5th Grade Math Workbooks | Education.com Math is part of everyday life, so learn math concepts with everyday examples. Learn to calculate sales tax, discounts, income, expenses and how to get more bang for your buck! 5th grade

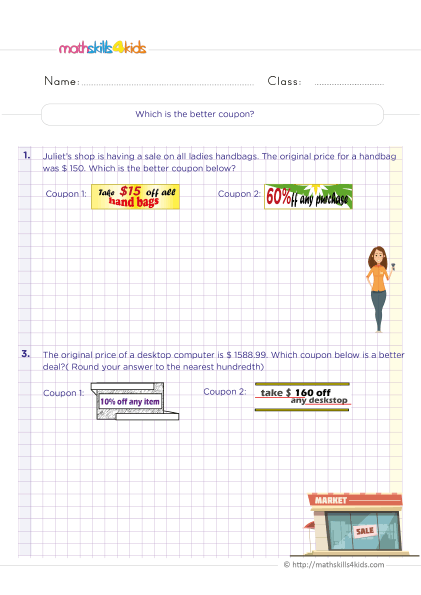

Sales Tax and Discount Worksheet Discount, Tax, and Tip Worksheet ... Tax: A tax on sales that is paid to the retailer. ... (Hint: Calculate the discount first and then the tax).

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Worksheet Practice Score (__/__) Directions: Solve the following problems on sales tax. Make sure to bubble in your answers below on each page so that you can check your work. Show all of your work! 2 3 4 6 7 1If a table costs $45 and the sales tax is 5%, what is the sales tax? 0.05 Sales Tax = $2.25

Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Worksheet See in a set (11) View answers Add to collection

Worksheet on Printed Price, Rate of Sales Tax and Selling Price Didn't find what you were looking for? Or want to know more information about Math Only Math. Use this Google Search to find what you need.

Trapezoid Bases, Legs, Angles and Area, The Rules and Formulas A trapezoid is a quadrilateral with one pair of parallel lines. Bases - The two parallel lines are called the bases.. The Legs - The two non parallel lines are the legs.

Property Tax Calculations and Prorations Math Worksheet This video takes students through a DETAILED explanation of how to calculate property taxes using T Bar formulas. There are multiple examples and all are wo...

Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets.

Self-Employed Individuals – Calculating Your Own Retirement ... Sep 22, 2022 · the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and; the amount of your own (not your employees’) retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values.

Calculating Sales Tax | Worksheet | Education.com - Pinterest Worksheets: Calculating Sales Tax Volume Worksheets, 4th Grade Math Worksheets, Geometry Worksheets,. education_com. Education.com. 301k followers.

Math.com Calculators and Tools Free math lessons and math homework help from basic math to algebra, geometry and beyond. Students, teachers, parents, and everyone can find solutions to their math problems instantly.

Capital Gains Tax Calculation Worksheet - The Balance Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock.

Calculating Tax- purchase worksheet ID: 1239539 Language: English School subject: Math Grade/level: Special Education Age: 11+ Main content: Making purchases, calculating tax Other contents: addition Add to my workbooks (11) Download file pdf Embed in my website or blog Add to Google Classroom

Everyday Math Skills Workbooks series - Money Math - CDÉACF invisible. But math is present in our world all the time – in the workplace, in our homes, and in our personal lives. You are using math every time you go to the bank, buy something on sale, calculate your wages, calculate GST or a tip. Money Math is one workbook of the Everyday Math Skills series. The other workbooks are: • Kitchen Math

Calculating Total Cost after Sales Tax - Liveworksheets.com You can do the exercises online or download the worksheet as pdf. ... Finding Sales Tax and Total Cost after it is applied. ... School subject: Math

:max_bytes(150000):strip_icc()/menu1-56a602543df78cf7728adf15.jpg)

0 Response to "45 calculating tax math worksheets"

Post a Comment